Bookkeeping

Kostov Accountants® is your one-stop-shop for bookkeeping and accounting.

There are substantial differences between the services offered by bookkeepers and accountants, yet both are important to help you achieve your business goals. However, instead of viewing it as a ‘bookkeepers vs accountants’ scenario, it is important to understand that your accountant and bookkeeper work best together to serve the financial requirements of your business.

At Kostov Accountants®, we are proud to “get our hands dirty” and make sure the bookkeeping of our clients is set up and done correctly, which translates into lower fees for the EOFY financial report and tax return preparation and lodgement.

In order to understand the benefits that both bookkeepers and accountants can offer to your business more comprehensively, it can be helpful to be aware of the tasks that each could be expected to undertake.

What is Bookkeeping?

Bookkeeping is a growing profession – it is demanding, exciting, challenging and above all, rewarding. It is about understanding how a business works and then providing accurate figures that enable the business to know exactly how well it is doing. For men and women of all ages and from all backgrounds it provides outstanding career opportunities.

The basic system of double entry bookkeeping was invented more than five hundred years ago by a Cistercian monk called Luca Pacioli. His system still endures today and is used throughout the world, making bookkeeping a truly international profession. The ICB website will give an understanding of how to train to become a bookkeeper and how to become a member of the Institute. It will also help those who already have a qualification or have been working as a bookkeeper for many years but now want the support of a professional association to enhance career prospects.

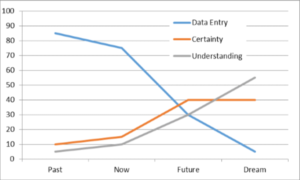

Bookkeeping today is far more than entering data and reconciling the bank. Bookkeeping is thinking about the needs of the business, thinking about the processes to get the desired result.

Firstly, what is expected from standard bookkeeping?

- Processing purchases, sales, receipts, payments

- Processing payroll and maintaining entitlements and employee records

- Bank reconciliation

- Providing reporting for preparation of a BAS

- Producing reports for both management and accountant

- Record keeping

Good bookkeeping now includes above and beyond this standard process to ‘think’ more about each stage and ask the questions ‘can we do this better’ and ‘is bookkeeping part of the natural business system?’ Have I captured all the relevant information required to produce an accurate result?

Also note that a required standard should be that any qualified bookkeeper or accountant should be able to step in and work on the file for the business without needing to reinvent or research too significantly.

What is the difference between a bookkeeper and an accountant?

There is often a misconception that bookkeeping and accounting are the same thing. However, while both work to assist you with your finances, there are some important distinctions between their tasks.

From the outset, it is important to understand that both bookkeepers and accountants are integral parts of your business. While their tasks can sometimes overlap, there are definitely certain aspects of your business that you would entrust to an accountant and others that you would give to your bookkeeper.

In simple and very general terms, a bookkeeper will likely be the person that assists you with the ongoing financial recording and transactions that keep your business running smoothly. Your accountant, on the other hand, will be the person who analyses the data produced by your bookkeeper, reports on it, and is best suited to give you financial advice.

Your accountant will also have a strong understanding of your taxation requirements and will actually lodge your tax return, whereas a bookkeeper is not allowed to lodge tax returns for a fee.

The role of the bookkeeper

Bookkeepers, as previously stated, are instrumental in the preparation of the ongoing financial reports, be it on a daily, weekly, fortnightly, monthly, quarterly, bi-annual or annual basis. Some tasks that could be regularly undertaken by your bookkeeper include:

• Managing your accounts receivable and accounts payable including amounts owing by debtors and amounts owing to creditors.

• Processing invoices, receipts, payments and other financial transactions.

• Designing, establishing and reviewing accounting systems.

• Reconciling accounts and preparing reconciliation reports.

• Processing and maintaining your payroll system.

• Preparing DRAFT financial statements.

• Preparing and lodging your BAS.

• Preparing budgets.

• Calculating GST.

A bookkeeper can also undertake a variety of other tasks that are generally related to the ongoing maintenance of your financial report. A good bookkeeper can be viewed as a management accountant and the person who keeps your business finance up-to-date and compliant with the relevant authorities. They also provide the necessary financial information in a timely manner for decision-making purposes.

While an accountant will also be qualified to assist you in the above areas, it is important to be aware that there is likely to be a substantial difference in fees charged by bookkeepers and accountants. Therefore, in order to best utilise your budget, extensive consideration into which tasks are to be delegated to a bookkeeper or an accountant is advised.

The role of the accountant

The role of an accountant in your business, while potentially encompassing some bookkeeping tasks, is often more advisory and analytical in nature. An accountant will be in a position, through analysis of past performance, to offer financial projections and advice on future financial elements of your business.

Services offered by your accountant can also include:

• Corporate reporting and compliance.

• Business establishment assistance.

• Financial management advice.

• Taxation advice and planning.

• Superannuation fund advice.

• Auditing.

While not an exhaustive list of an accountant’s services, the tasks outlined here serve to highlight the analytical and advisory nature of their position.

Contact Kristian at Kostov Accountants® by filling out the contact form or calling him directly on 0409 871 861.